Financial Accounting Introduction (2/2) – Financial Statements

Financial Statements- are reports published by the company that are for sharing information externally

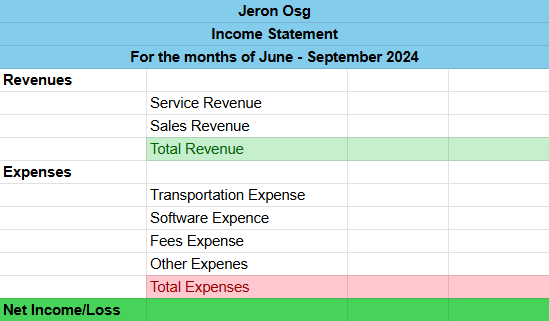

1. Income Statement

The income statement is responsible for reporting revenues and expenses over a period of time (such as year, quarter, and month)

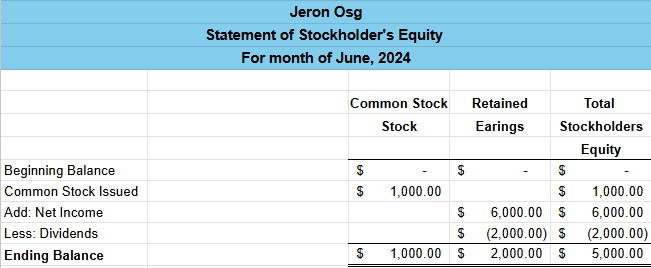

2. Statement of Stockholder’s Equity

The statement of stockholder’s equity is responsible for reporting the stake that stockholder’s have in a company and its retained earnings.

Stockholder’s Equity = Common Stock + Retained Earnings

Common Stock (external)- are amounts invested by stockholder’s when they purchase stock

Retained Earnings (internal)- are all the net income minus all the paid dividends over the life of the company

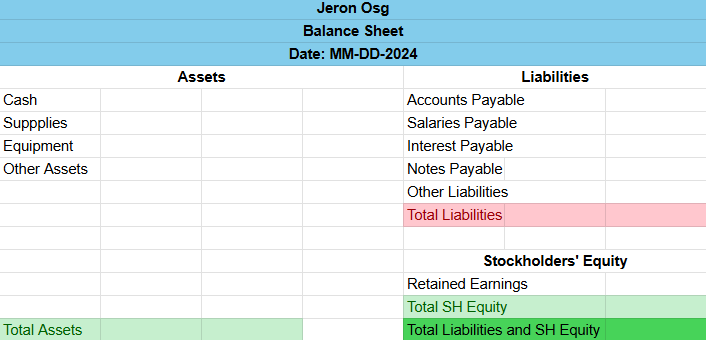

3. Balance Sheet

The balance sheet is responsible for reporting the financial state of a company on a specific date.

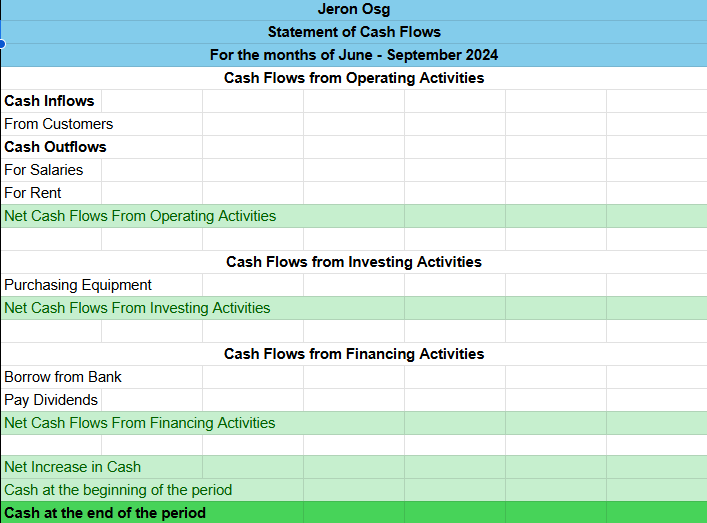

4. Statement of Cash Flows

The statement of cash flows is responsible for reporting and measuring the activities that involve cash over a period of time (such as a year, quarter or month). There are three main parts to this statement:

Operating Cash Flows

Investing Cash Flows

Financing Cash Flows

Cash receipts and cash payments involving revenue and expense activities.

Cash transactions for purchase and sale of investments and long term (multiple year) assets.

Cash transactions with lenders (debt) and with stockholders (dividends)

5. Notes (optional)

Accountants may choose to add notes to the end of their consolidated statements. These notes can be explanations of transactions, accounts and more information that accountants think may be useful to external users.

Learn More About Financial Accounting

Learn more financial accounting here

See Outside Resources

https://en.wikipedia.org/wiki/Financial_accounting

https://www.investopedia.com/terms/f/financialaccounting.asp

Sources

Much of the information in this is from “Financial Accounting, Sixth Edition” from David Spiceland, Wayne Thomas, and Don Herrmann.

Please note, that this is NOT copied information, but much of what I am stating can be considered a “summarized version” of the information in this book.